Name of the Child

Marriage Expense: Present value (₹)

Child's Current Age

Child's Marriage Age

Inflation Rate

Total Amount Required for marriage of

₹ 100,000

Present Value (₹ 30,000)

Future Amount Required (₹ 100,000)

We live in a country where marriages are sacred and are celebrated in high spirits. Each one of us would dream of getting married in a most lavish way or get our children married the way they want. Marriage is a once in a lifetime event that has immense importance in our lives. However, for anyone to plan for their child’s marriage, financial planning is utmost needed. In the current economy where inflation has taken over, it gets difficult to incur the high expenses. Hence, we bring child marriage calculator to help you plan your child’s wedding expenses.

The child marriage calculator will guide you through how much to save for child marriage. It is a step-by-step guide to invest from now and get the desired results based on your convenience to invest. Once you know the present value of the event, the calculator shows you the total amount required to invest at this point in time. Budwisefunds have made it simpler for you to plan the dream wedding without incurring high expenses at one go.

The factors that will play an important role in investment are inflation rate, your child’s age, and expense you wish to make. However, our calculator will help you to pre-plan the entire wedding expenses as it may turn challenging if not well-planned.

We have designed the calculator to help the parents to plan their child’s wedding in the most prominent way. Child’s marriage is a huge expense that should always be planned in a proper manner. How much to save for child’s marriage is the most important question for each parent here. The child marriage calculator will help to get you through this problem which is very simple to use and does not require any skills. Below are the steps that will help you to use the calculator proficiently.

Name of your Child: Enter your child’s name for whom you would like to plan the wedding expenses. The reason for keeping this tab is that you may have more than one kid and we would not like you to get confused while planning your children’s wedding expenses. You may plan the investment for all your children if you wish to. It’s always better and advisable to plan well in advance.

Marriage Expenses: The marriage expense tab asks you to put down the current value of the expenses that you would like to make. The present value can be determined based on your willingness to spend as it does not have any upper limit.

Current Age: The next tab asks you to put down the current age of your child. The age factor helps us to get to near to the exact value that you need to invest right now.

Expected Marriage Age: The expected age of when your child will get married is what we need here. This tab helps us to get the difference between your child’s current age and expected marriage age. The figure reached will be your investment period during which you have to invest your money so as to reach your goal in time.

Inflation Rate: The rate of inflation is the expected change in the value of expenses in the coming years. The inflation rate can also be calculated by considering the historic consumer price index and then converting it into a percentage.

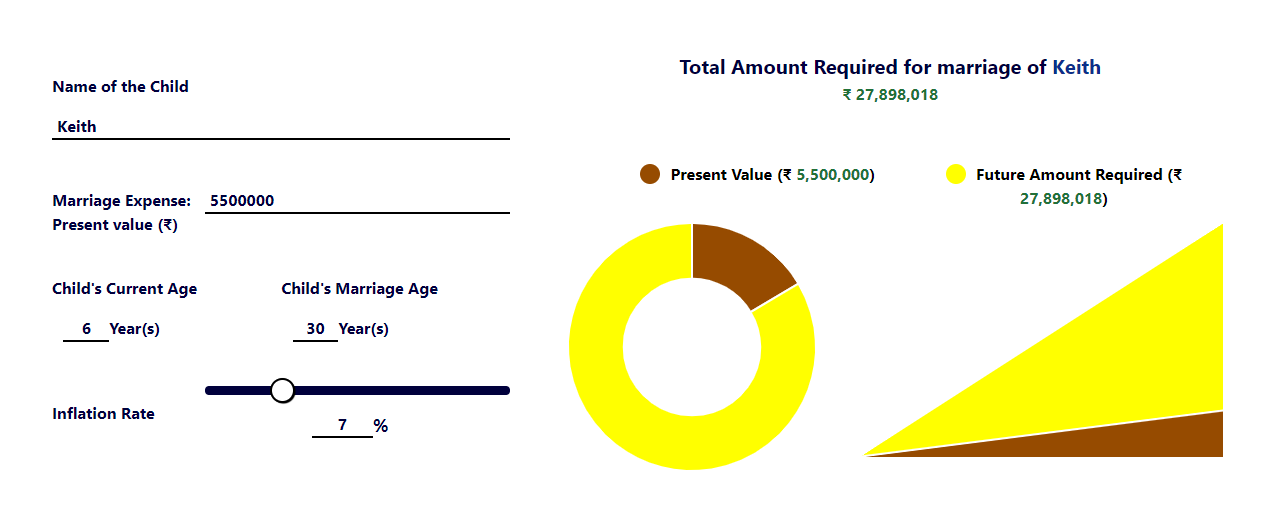

The above Picture 1 is a dummy calculation where we have assumed:

Marriage Expenses = ₹ 55,00,000

Current Age of Child = 6

Expected Marriage Age = 30

Inflation = 7%

In this case, the amount required for marriage comes to ₹ 2,78,98,018.

Child’s marriage holds a special place in the parent’s heart. However, it is not always possible to pay the high expenses in the last minute which can affect the event. Budwisefunds believes in fulfilling the parent’s dream and has brought a unique calculator which will help you achieve your goal successfully.

Budwisefunds helps the investor in determining the amount required for your child’s marriage. Once you know this amount, you can invest in one of the best child marriage plan in India based on the returns. With the investments, you can reduce the headache of last-minute expenses and save in small chunks. It is always better to plan and invest rather than paying the entire amount at one go as marriage expense involves a huge chunk of money.

There are a couple of factors that play a crucial role in the outcome of your investments. The research has shown that long-term investment proves to be beneficial due to a lower rate of inflation as compared to short-term investment. Also, the instrument you select for your child marriage goal plays an important role. Say, for instance, people in their 30’s to 40’s can plan their investment in equity. However, if you are above 50, 100% equity investments might not work for you. Other than the equity mutual funds, there are various options that can be considered by the investor such as ELSS,debt mutual funds,liquid mutual funds and so on.

Equity is one of the best instrument to get higher returns. The history of the last 10 years has shown that NIFTY has shown an increase of 16.7% over the inflation of 7%. The reason behind these fluctuations is the fluctuating market which adjusts itself with inflation and provides returns to the investor.

The instruments other than equity tend to give lower returns due to its distributed ratio between equity and debt funds. In this case, it might happen that the returns cannot beat the inflation rate and can eat up the corpus. The adjustments between inflation and the rate of returns are subject to this phenomenon. Hence, it is always advisable to invest in equity funds subject you fulfill some important criteria such as your age and risk appetite.

As described above, inflation can compete to the rate of interest which might eat up your corpus. The historic rate of interest has been between 6-7%. Whereas, the rate of return varies in each investment plan. In case you choose a debt fund or if the ratio of your plan has more weight on debt, it is possible that it might not go above the inflation rate. In this case, it may affect your child’s marriage if you get low returns on your plan.

When you make a goal-oriented investment plan, it is important to study the history of the plan. However, you should not look for short-term returns in case you are aiming for a long-term plan. Returns over the period of 5-10 years should be studied before investing. The goal-based investment plan needs to align with the historic returns as it is a long-term plan.

Let’s understand this with the help of an example. If you invest in a plan which has given returns between 6-8% in the last 5 years and the inflation rate being 7%, this plan might not work for your criteria and goal. In this case, the inflation will eat the returns and you will get 0.5-1% returns on the investment which is not what you need. Hence, you should look for the options giving at least 11-16% returns when the inflation is around 7%. There are some of the best child marriage plan in India which can be considered for goal based investment.

India is a country with high religious values. The importance of marriage in our society lies beyond what we compare with money. It is a huge social gathering which is once in a lifetime moment for parents and children, both. The tradition in India is such that parents tend to plan their child’s marriage from the day they are born. It is something that cannot be weighed with monetary aspects as there are intense emotions attached to this event.

The traditional values in India are high for which we have created child marriage calculator that helps the parents in pre-planning the finances.

There are various plans that can be considered for your long-term goal of your child’s marriage. The child marriage plan comparison can be made between equity mutual funds, debt mutual funds,PMS and bank FD. There are various large-cap equity mutual funds that give average returns between 11-18%.

The next option is PPF which has 8% returns fixed by the government.

The next option is Portfolio Management Services (PMS) which has given 15%-18% p.a. in five years horizon but minimum investment amount required to invest in PMS is 25 lacs.

And the last option is bank FD which has interest rates in the range of 6.25-8.5% depending on the bank, tenure, and some other aspects.

Q1. Can I invest in debt funds and get higher returns?

A. Debt funds are safe in comparison to equity. Hence, they do not give high returns like in equity funds.

Q2. What should be the minimum tenure of my investment?

A. Long-term investments should have a minimum tenure of 5 years. The maximum tenure is not fixed as it depends on your goal and age factor.

Q3. Can I invest in cash?

A. Yes. Cash investment of 50,000 rupees per investor for per financial year can be made. However, redemption or repayment is done only through the bank.

Q4. What inflation rate should I consider for my child marriage?

A. Expected inflation in the case of child marriage can be taken as 10%.

Q5. When should I start investing for my child’s marriage?

A. It is always better to invest upfront. One should not wait for the deadline/event to come.

If you still have any other questions/ queries in mind, do not hesitate in contacting us.

8AM - 8PM (Mon - Sat)