Target Amount (₹)

Time Period

Return Rate

Monthly Investment Required (₹)

₹ 4,300

Total Investment (₹ 30,000)

Target Amount (₹ 100,000)

As human beings, we always have various life goals such as retirement planning, child’s marriage, and education. Target Value Calculator helps the investor to reach the aim of their goal-based investment. Goal-based investment is a comparatively new approach of investment which lays its importance on life goals.

Goal-based investment (GBI) is said to be one of the best methodologies of wealth management as the investor is clear about the intentions. Investment firms or wealth manager are the concerned parties who take care of the goal-based investment. The wealth managers or investment firms keep track of the progress towards the specific goals rather than just focusing on the returns.

The goal-based investment has its own advantages such as:

1. It helps the investor to be more committed towards the life-goals and keep track of its tangible progress;

2. It prohibits impulsive decision making and encourages a proper strategy for respective life goals based on market fluctuations.

At Budwisefunds, we encourage goal-based investment because of its transparent approach. It helps the investor to re-frame the success based on the life-goals and market fluctuations. In recent years, several teams have worked on holistic investment approaches and strategies. Goal-based investment is the result of these teams who have brought this concept in our lives.

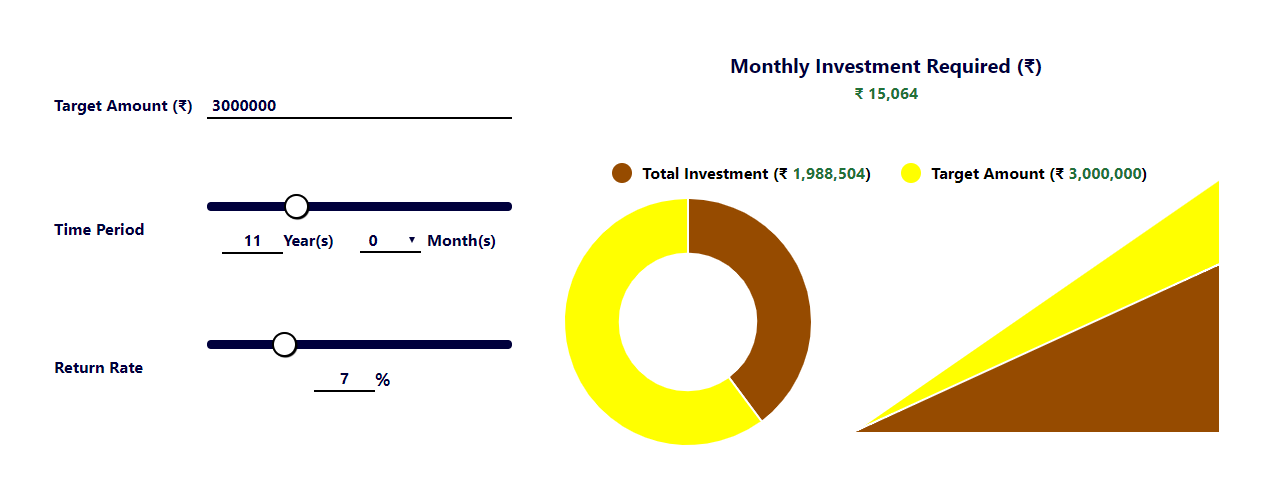

Target value calculator helps the investor to achieve their life goals proficiently. When a goal-based investment is made, it becomes easy for the investor to connect the dots and achieve goals easily. The calculator is designed in a way that asks your desired target amount and shows how much monthly investment is required to achieve the goal. It is built in a way that does not require any special skills or financial knowledge.

You must be thinking about how to decide the target value in order to achieve the planned goal? It is really simpler than you think. There are two ways that this approach can be worked on. First, you will have to fix a goal for which you are planning the investment. Once you have a goal, you must get the future value by using our Future Value Calculator. And this amount should be your target value. Secondly, if you don’t have any such particular goal, you can decide an amount or future value you would like to have after a certain period of time. Once you decide this amount, it becomes your target value.

The target value calculator for investment gives you the opportunity to decide and plan your investment in your personalised way. The monthly investment required can then be invested in large or small-cap funds depending on your goal and the span of time.

The calculator is designed with an aim to help the investors achieve their life-goals or plan their financial targets. It helps in tracking the progress of the goal with the help of our online investment portal. The calculator is designed in a user-friendly way and you will need to follow below simple steps to find out your monthly investment required to reach the target.

Target Amount: The target amount can be anything such as your goal-based investment or any amount that you would like to receive after a particular span of time. You may take help from our Future Value Calculator to reach the target amount or can decide by conducting your own research.

Time Period: The required time of your goal-based investment should be entered in this tab. It is the time period between the day when you intend to start your investment to the day you will need the amount or the targeted time.

Return Rate: The return rate is the rate which you are receiving/expected rate of your investments.

The above Picture 1 shows a goal-based investment needed for my child’s education who will be pursuing higher education after 11 years. Here, I have calculated the required monthly investment if I would need ₹ 30,00,000 at an return rate of 7%. In this case, the monthly investment required comes to ₹ 15,064. Similarly, you can also make your own goal-based investment plan using the calculator and achieve your goal successfully.

The calculator is used to determine the monthly investment needed for a desired target or outcome. The target value calculator for investment helps the investor in reaching his or her goal if the investment plan is based on any particular goal. Also, the investor can plan the investments merely with a target amount without setting any goal. This way, the investor can make personalised financial planning based on his needs and goals.

With the help of the calculator, one can easily plan multiple financial goals and invest accordingly. Each goal in our life has different priority but are equally important. It is really important that we plan our goals based on the priority and not rush into anything. For instance, if you want to plan for your retirement, child’s education, and child’s marriage; you will have to arrange these goals based on your priority. According to your priority, your life goals should be a child’s education, a child’s marriage and retirement. Further, you can now easily calculate the target amount and monthly investments needed to achieve these goals.

Hence, the calculator is the investor’s best friend when it comes to financial planning. It becomes a lot easier when we know the current monthly investment that we need to make to achieve our life goals.

The calculator has numerous positive sides that help the investor in managing the finances and achieving the financial goals. There are always multiple financial goals that we need to plan. The calculator, based on your need and priority helps you to manage these goals and achieve them. Also, the target calculator is directly related to goal-based investment approach which is one of the most successful approaches in current time. The goal-based planning helps the investor in understanding the purpose of the investment which increases the success ratio of the investment.

The calculator helps in making you understand your life goals and planning your finances based on your priorities. Also, this holistic approach has the support of professional wealth managers or investment firms that help the investor in planning their finances or managing their wealth. These professionals keep a track on your investments and work in sync with the pre-determined goal. Their knowledge and experience make it possible to achieve the goal without any hustles and worry.

Hence, the calculator is something that can be used to achieve your life’s most important dreams or goals. It makes you positive for investing and planning your wealth way ahead of the situations that are going to take place in the future. We don’t know what awaits us in the future. So, it is always beneficial and advisable to plan way ahead and enjoy the fruits in the future.

Determining the target amount is not a difficult task but you need to keep somethings in mind before you plan. It may not require any skills but consulting a professional can be an option if you lack the basic knowledge. However, some basic things which should be kept in mind before arriving at the target amount are:

• The current value will not be equal to the future value of the amount. You may here wish to use our future value calculator to know the future value of the amount.

• Inflation plays an important role in any investment. It is better if you study the historic rate of inflation and determine the current rate.

• The inflation rate can eat your corpus if you don’t invest in the appropriate investment scheme.

• The target value can be linked to your life-goal and can be invested accordingly.

• You need to know the future value of your goal to make the plan successful.

• Always set up your priority before you plan your financial goal further.

• Goal-setting can sometimes be illogical.

• Be smart and practical when you determine your target amount.

The above points will help you to determine your target in a better way. There would be instances when you would need professional help. If the need arises, do not hesitate to consult your advisor as it is the matter of your finances and should not be taken lightly.

Q1. How can I do a goal-setting?

A. Goal setting can be done by listing your life goals and setting them on priority. You can find the present value of each of them and start investing based on priority.

Q2. I am a conservative investor. What kind of returns should I consider?

A. You can expect returns in the range of 9-10%.

Q3. Should I seek professional help before investing?

A. Yes, as a new investor you should seek professional help in order to avoid mistakes. You can avail our services anytime you want.

Q4. Can I invest by myself on your website?

A. Yes, you can invest either directly in the funds recommended on our website or can invest by contacting our advisors.

Q5. How much should I invest each month?

A. You can use our target value calculator in order to find monthly contribution.

If you still have any other questions/ queries in mind, do not hesitate in contacting us.

8AM - 8PM (Mon - Sat)